Friday, June 6, 2008

Opportunity for Low Credit Score Borrowers with FHA

Up until about 6 – 8 months ago I may have agreed with you, to some extent that the market was gone or is going away for “sub prime” borrowers. But now in today’s new lending environment the government, of all organizations, has stepped in to offer a solution.

FHA, also know as the Federal Housing Administration, is now the official reigning champion over the sub prime lending industry. They offer lending solutions for borrowers with less than perfect credit. However, the highlight of using FHA for financing is the range of service that they offer.

For example, if your not quite sub prime but you’ve had a few blemishes in the past, FHA just might be the solution. With an FHA loan you can have access to the same competitive pricing that “Prime” conforming borrowers have but without being concerned about fitting in a qualification box.

The truth is that I have more and more clients that come to me looking at their options for a rent to own that end up getting pre-approved for FHA financing. Now they are able to purchase a home of their own when they never thought they could even qualify in the first place.

FHA loans are a true manual underwriting process, which means that if the loan makes sense to the underwriter, they will approve you. There actually are very limited guidelines and each loan is on a case by case basis. You need to work with a good Loan Officer that is familiar with FHA and the process of getting you approved.

It would be very difficult for me to write out each thing to look for with an FHA loan, so if you have questions about utilizing this loan for you, feel free to give me a call and we can discuss your options.

Dedicated to your financial success!

Kenton Becker

kentonb@empireoptions.com

Managing Partner / Land Home Financial Specialist

License # 510-LO-36929

http://www.empireoptions.com/

Friday, May 9, 2008

Things My Mother Taught Me

Our Mom’s taught us…

LOGIC..."If you fall off that swing and break your neck, you can't go to the store with me." MEDICINE..."If you don't stop crossing your eyes, they're going to freeze that way."

TO THINK AHEAD..."If you don't pass your spelling test, you'll never get a good job!"

TO MEET A CHALLENGE..."What were you thinking? Answer me when I talk to you...Don't talk back to me!"

HUMOR..."When that lawn mower cuts off your toes, don't come running to me."

BECOME AN ADULT..."If you don't eat your vegetables, you'll never grow up. GENETICS..."You are just like your father!"

ROOTS..."Do you think you were born in a barn?"

WISDOM of AGE..."When you get to be my age, you will understand."

ANTICIPATION..."Just wait until your father gets home."

Best of all JUSTICE..."One day you will have kids, and I hope they turn out just like YOU…then you'll see what it's like."

I want to say Happy Mothers day to each mom that is receiving this. We all appreciate everything you do.

Happy Mothers Day!

Dedicated to Your Financial Success,

Kenton Becker

kentonb@empireoptions.com

Managing Partner / Land Home Financial Specialist

License # 510-LO-36929

http://www.empireoptions.com/

Friday, April 25, 2008

Is Your Bank Qualified to Work With YOU?

I’m guessing the bank or loan officer told you this. So how do you really know if your bank or loan officer is qualified to work with you? Not all loan officers and banks have the same access to programs, and these programs (that you may not be aware of) can help you get into a home today, rather than go through a lease option.

I deal with many clients that come through our lease option program convinced that they are unable to qualify for financing and honestly for some of them that may be true. But I also find that there are many that fit a variety of loan programs that we offer. Now, I must admit, I am a loan officer and I do work for a Bank / Brokerage but the difference between us and them, is the variety of service that we can offer our clients. Seriously…we can help everyone from the “really” qualified conforming loans, to the FHA government loans, VA loans, 1st time homebuyer state regulated loans…and yes, if you can’t get financing, the lease options. In fact there are not too many clients I come across that we can’t help.

So based on this information, have you really given your credit a shot, or your down payment. Did you know that there are loan programs out there that have less than $500 down payment (did your loan officer tell you that?) Or how about no credit score requirement? These are all different tactics that I use to help each of my clients achieve home ownership.

So don’t take “no” for an answer. Make sure you explore all your options before you settle with a solution. Remember, if you have any questions I’m here to help, I think you will find that I am more than qualified.

Dedicated to Your Financial Success,

Kenton Becker

kentonb@empireoptions.com

Managing Partner / Land Home Financial Specialist

License # 510-LO-36929

http://www.empireoptions.com/

Friday, April 11, 2008

My Favorite Benefit…It’s YOUR Home! Fourth Benefit of Lease Options.

The home ownership mentality is so powerful that once you experience it…there’s no turning back. Just talk to any homeowner that has had to rent in the past and they will tell you that there’s nothing like it. So you don’t like the color of the walls…paint them. You want a new kitchen…remodel it. When you own your own home you have the ability to make these decisions.

Now, here’s the other nice thing about being in your own home. How many of you have ever been kicked out of a rental by the landlord? It happens all the time, the landlord needs to sell the house or they just want to get a new tenant. I have even seen landlords change the terms on the lease just to tick off the tenant enough that they would want to leave. With lease options you won’t need to worry about that happening. Since you have the option to buy this home within 2 years; this gives you exclusive rights to it. And no landlord can take that away from you.

So if you have only dreamed about homeownership, its time to start making it a reality. All of the other benefits that have been mentioned are great and on a financial level very attractive…but this is the only one that hits on an emotional level. Provide the home that your family has always wanted.

Reply to this email, give me a call or visit our website at http://www.empireoptions.com/, if you have any questions about how our program can help you and your family get into a home today.

Dedicated to your financial success,

Kenton Becker

kentonb@empireoptions.com

Managing Partner / Lakemont Mortgage Specialist

License # 510-LO-36929

http://www.empireoptions.com/

Thursday, April 3, 2008

Rents Are Increasing…Has Yours? Third Benefit of Lease Options.

Well don’t be a statistic anymore. Just in case your wondering what the numbers look like…here they are.

Last year, the average rent in King and Snohomish counties for all apartments rose 8.6 percent, reaching $1,012 in the fourth quarter of 2007, according to the most recent report from Seattle-based Apartment Insights Washington, which surveys 150,000 apartment units on a quarterly basis. Over the past two years, since the first quarter of 2005, rents have climbed 16.7 percent.

Copyright © 2008 The Seattle Times Company

When I look at that, I am shocked! I don’t understand why so many people continue renting when it costs so much. Now some of you may be thinking $1,012 per month is pretty cheep…but their talking about apartments. If that were a Single Family Home at $1,500 per month, it would have climbed $250 to $1,750! That’s amazing!

It’s time to stop renting and start putting your money to work. Lease options are a great tool to do this. Your payment is fixed the whole time you are in the home and just like a mortgage it is applied to paying off the balance each month. I don’t know about you, but I would rather put my money into something that is mine rather than putting it in the landlord’s pocket.

Some of you may think, “Well I can’t qualify”. I would bet that most of you are paying rent close to what you would pay for the same home in our Rent to Own program. If you don’t believe me, just give me a call and we can run the numbers to find out.

Hopefully I will hear from you soon and we get you into the home that you choose for your family.

Dedicated to your financial success,

Kenton Becker

kentonb@empireoptions.com

Managing Partner / Lakemont Mortgage Specialist

License # 510-LO-36929

http://www.empireoptions.com/

Friday, March 14, 2008

Is Appreciation Still a Benefit of Lease Options?

So up to this point I have only given a big overview of what the benefits of lease options can be. But I haven’t spent time in detail on each thought. This may shed some insight to why a lease option makes sense vs. where you may be at right now.

The first benefit I would like to talk about is probably an area that we have heard a great deal of commotion about over the last year, no, its not politics although it does have to do with our economy…have you guess it? Its appreciation.

If you just listen to the news all day long you may think “what are you talking about, we are in a declining market”. Well despite all the media's infinite wisdom, they may have only got it partly right. Would I agree that our market is not appreciating at the same rate as 2002 – 2004, absolutely. Is our market in the negative, NO WAY!

To answer the question more in detail, if you compare our appreciation rates today to where they were at 2 years ago…then yes they have gone down. But then again our market 2 years ago was definitely not a normal market. Appreciation rates in the double digits each year (some areas had appreciation rates that were double digits each quarter) is not normal! But the fact is that the market we are in right now, in our backyard, is a NORMAL market.

Currently our area is seeing appreciation rates of 7.1% (King County) and if you average out each county (King, Pierce, Snohomish, Kitsap) the entire Puget Sound region is appreciating at 6.08% *. (Condos were at 28% average appreciation for Puget Sound!) Wait a second…”that’s not what the news said, they said that our area was depreciating and in the negative”, well like I said before, they only had it partly right.

*(Seattle Times, 01/22/2008, Elizabeth Rhodes, www.seattletimes.com)

The reason why our market is still appreciating is for 2 main points (and one of them is not because it is so beautiful here, although that’s why I like it). The first main reason is employment. Consider this; right in our back yard we have some HUGE companies fueling our employment rates. Here’s a portion of them, Microsoft (Redmond), Costco (Issaquah), WAMU (Seattle), Weyerhaeuser (Federal Way), Amazon.com (Seattle), Expedia.com (Bellevue), Nordstrom (Seattle), Starbucks (Seattle)…shall I go on?

The 2nd big point has to do with geography. I know what you’re thinking…”I knew you were going to say it was beautiful”…no that’s not what I mean. Take a look at the list above, what do you notice? All the business are in the same areas. The Puget Sound has a nice geographical funnel, mountains to the east, water to the west. Your only option for expansion is north or south. Most states have the ability to expand circular around large employment areas…but not us and most people don’t want to spend more than an hour on I-5 to get to work, so they keep buying locally. This drives prices up; now does it all make sense?

So for our lease option program our clients can expect to see anywhere from 5% - 10% of equity when they finally take over the house in 2 years. This is huge difference compared to waiting 2 years and then purchasing. Not only will home prices be higher if you choose to do that, but you are rolling the dice on what our market can do.

So there you have it. Big benefit in our market today, Appreciation! Get into a lease option and watch your home value go up!

If you would like more information about lease options, visit our website at www.EmpireOptions.com or feel free to give me a call. I am here to help.

Dedicated to Your Financial Success!

Kenton Becker

kentonb@empireoptions.com

Managing Partner / Lakemont Mortgage Specialist

License # 510-LO-36929

http://www.empireoptions.com/

Friday, March 7, 2008

How does your credit look?

Last month I talked about credit repair for a few weeks. I know that some of you really took to heart with what I was saying and ultimately took action. For some, after looking at their credit report, it was basically what they expected and for others they were shocked!

Remember what I said a few weeks back…”Did you know that 79% of Credit Reports contain errors?” That means about 8 out of every 10 people that receive this email will have errors on their credit report! Think it could be you? There’s a good chance it is!

The first step to find out what your credit looks like is to have it pulled. Don’t be so afraid of this, you can accomplish this step and its necessary to brave it out before you can address the problems.

Once you’ve gotten over the mental road block of not wanting to pull your credit, maybe you say, “Well, I can just pull my report for free online”. That’s absolutely true…and I would recommend you do that once per year, but just as a refresher. Sometimes once is not good enough, especially when you are trying to get your credit in line to do something big in the future. Purchasing a home, a car, or anything that you plan on financing; your credit will have a huge impact on.

Even if you don’t plan on financing anything in the near future, you still have to qualify for landlord credit checks, or even for employment; they are checking credit more and more. Unfortunately, whether you like it or not…life can revolves around credit and for some that’s their best way of determining what type of person you are. That could be scary for some of you.

In addition to this you want to make sure that the information you are looking at is also the most accurate. Sometimes the free credit reports are, well…free, so the information is not the most up-to-date. So you should have your report pulled by a mortgage specialist. We have access to the most up-to-date credit reporting software that will make sure your report is 100% current (this doesn’t mean accurate…that’s why were checking it).

From there we can analyze your report and recommend a credit repair option…if it’s even needed. Who knows, you may not even need credit repair like you thought. However, if you do…here’s what I recommend (and don’t worry, I will help you determine if you need this or not)…

- Go to www.CreditandFinancialWellness.com and click on Credit Repair.

- Read through the brief information on Lexington Law, our approved and reputable Credit Repair Company that has attorney’s fighting for your credit.

- Click on the “Sign Up” button, enter in the Lexington ID Code and fill out your information.

Congratulations! You are now on the fast track to improving your credit and your overall financial picture!

If you have any questions please let me know. I will be more than happy to help.

Dedicated to Your Financial Success!

Kenton Becker

kentonb@empireoptions.com

Managing Partner / Lakemont Mortgage Specialist

License # 510-LO-36929

http://www.empireoptions.com/

Thursday, February 21, 2008

Does Your Down Payment gotcha…well…Feeling Down?

MGIC, the nation’s larges mortgage insurance lender has now tightened up their guidelines on down payment rules. What does this mean for borrowers? Well, if you have less than 5% to contribute to your down payment…you better have a 680 credit score. If you don’t have that, then sorry, you’re out of luck.

Just to give you a little educational moment…brought to you by Kenton Becker, What is Mortgage Insurance? Well, simply put it is the insurance that lenders take out to make sure that if you don’t make your payments they will still get paid. Easy enough, right?

What’s that you ask…How is mortgage insurance calculated, well thank you, I’m glad you asked. Mortgage insurance is calculated as a premium you pay monthly if your loan amount exceeds 80% of the value of the home. For example, if a home was worth $100,000 and you borrowed anything more than $80,000, you would be responsible to pay mortgage insurance every month.

SO essentially you are paying the insurance payment. Not all that bad if you don’t have to bring in the extra cash for a down payment. Consider it financing your down payment. Well, as of March 3rd, 2008 you will have to think twice about that as an option.

For more information about this new change in MGIC’s guidelines, go to http://seattletimes.nwsource.com/html/realestate/2004185092_harney17.html

What are my options?

You have 2 options if you don’t have the money or credit to put on the line.

1st Option: FHA / VA loan.

Now, not everyone can do these loans. They are government regulated loans and it takes a very very special person to do them…that’s me! I’m just kidding, well not about the fact that everyone can’t do them. These loans are very old school, make sense underwriting, fully document everything loans. SO be prepared to show it all…literally. But the benefit is that you can do a loan with as little as 3% down…and some of that can even be covered by the seller.

2nd Option: Lease Option (Rent to Own)

Why does this make sense? Well, have you not been paying attention to all of my previous emails…ok, ok…I will explain it again, but really brief this time, this email is getting long :).

Lease options are when you lease a property for a certain period of time, with the option to buy it at a future date. It also allows you to essentially borrow someone else’s perfect credit while you get yours in line. The benefits are:

- That the down payment (the reason why I am writing this article) is very minimal, basically 1st and last months rent!

- You get the opportunity to buy the home in the future at a discounted price.

- Best of all you get into the home of your choice now, rather than waiting years to repair your situation and eventually get priced out of the market.

Well, I’m going to stop there. If you’re reading this then I congratulate you for making it through the email. Your prize is in the mail…just kidding. If you have any additional questions about your options, feel free to call me or email me and I would be more than happy to answer them.

Dedicated to Your Financial Success!

Kenton Becker

kentonb@empireoptions.com

Managing Partner / Lakemont Mortgage Specialist

License # 510-LO-36929

http://www.empireoptions.com/

Thursday, February 14, 2008

Top 10 Things to Love about Home Ownership

So here’s one way to see if you truly love your home. I have put together a top 10 things you love about your home list. I would say that if you can’t say yes to at least 7 out of the 10 things…we need to talk.

10) Back Yard – Now for some of you the idea of a yard is not a good thing. 1 word, condo. But for the rest of us, it is a place to relax and let the kids (dogs) unwind!

9) Garage – no more defrosting the windows on the cold winter mornings.

8) Neighbors – dang noisy neighbors, you won’t be able to hear them anymore.

7) Personal Touch – you can make all the changes you want to the home. You can finally hang pictures! (Everyone who lives in an apartment knows what I'm talking about).

6) Tax Advantages – talk to your tax advisor, they can deduct the interest from the mortgage.

5) Space - a home will provide more room for you to live.

4) Landlords – don’t have to deal with the landlords anymore…enough said.

3) Appreciation – our market is still increasing at 7% per year! What, you mean the news lied to you…no, never!

2) Fixed Payment – talked about this last week, if you missed it shame on you…just joking, just look at last weeks blog.

1) Finally a place that you can say is YOURS!

I’m sure everyone just got the warm and fuzzes when they read through the list, I know that I did. Maybe you’re saying “that would be nice to have all those things” to which my response would be…”WHY CANT YOU HAVE THEM”? I would bet that most of you haven’t even looked into your options yet to see if you can get into a home. Its easier than you think, that’s why I’m here, to make it easy on you.

But for the rest of you that have tried and failed (for lack of a better term) there’s still hope for you (that sounds so negative, I’m sorry). Seriously, that’s what I do, that’s what Empire Options was created for., to help families that are turned down for financing to get into a home. Pretty simple mission statement huh?

I want to help you make 2008 be the best year of your life. Please, give me a call and we can look into your options and help provide your family with the “Pride of Ownership” that you have been dreaming of, what are you waiting for?

Dedicated to your financial success,

Kenton Becker

kentonb@empireoptions.com

Managing Partner / Lakemont Mortgage Specialist

License # 510-LO-36929

http://www.empireoptions.com/

Thursday, February 7, 2008

Rental Rates Not So Reliable Anymore, huh?

Rent rates are not as reliable as you may think. I pulled this statistic out of the Seattle Times on Sunday:

Last year, the average rent in King and Snohomish counties for all apartments rose 8.6 percent, reaching $1,012 in the fourth quarter of 2007, according to the most recent report from Seattle-based Apartment Insights Washington, which surveys 150,000 apartment units on a quarterly basis. Over the past two years, since the first quarter of 2005, rents have climbed 16.7 percent.

Copyright © 2008 The Seattle Times Company

I have dealt with many individuals that have been scared to get into homeownership because they are afraid of their payment and rate increasing. Didn’t Einstein say that the definition of insanity is doing the same thing over and over again and expecting a different result??? Hmmm, so you continue to have rent increases and say that you don’t want a home because you don’t want it to increase…am I painting a clear picture.

Well maybe you say “I cant get into a home because I cant get financing” Ok, ok, ok…here’s what you are going to do, go to www.EmpireOptions.com, then review our program, then call me…presto! Answer to your problem!

We are helping countless families get into homeownership even though they have been turned down for financing. If you don’t understand how we can do this…go to www.EmpireOptions.com, then review…ok that’s enough. Seriously though, if you want to provide homeownership for yourself and your family, don’t wait…especially for your rent to increase. Get on the right path today, YOU can do it!

Dedicated to your financial success,

Kenton Becker

kentonb@empireoptions.com

Managing Partner / Lakemont Mortgage Specialist

License # 510-LO-36929

http://www.empireoptions.com/

Thursday, January 31, 2008

Have you signed up for the Credit Repair Yet?

If you haven’t signed up, what’s holding you back? It can’t be the cost, last week I explained how much it will cost you to live with bad credit. It’s a great amount more than the cost to fix your credit.

It can’t be that you don’t believe you have bad credit. Did you know that 79% of credit reports have false information on them? This can be caused by Identity Theft, or just the credit bureaus putting false information on there…it happens all the time.

Hmmm, maybe it’s because you don’t feel that you have the time for credit repair. Well, I couldn’t agree with you more, I don’t know very many people that do have the time to repair their credit. That’s the best part about our program, it doesn’t take any time. All you have to do is pick the items you want disputed and their off to the races. When you receive your letters back from the bureaus you just send them into your team of paralegals and presto! That’s it. If the process needs to be started over again, they do it for you. It’s really that simple!

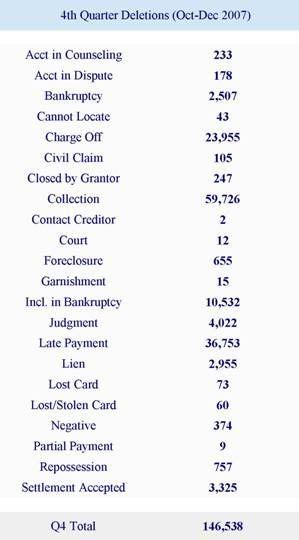

You know what I think it is. I think that you’re saying to yourself, “Self, I know that everyone says you can repair your credit, but my credit is way too bad to fix…” I want to give you some statistics that may change your mind. Keep in mind that these numbers are only from October 2007 – December 2007!

So if you think that it’s impossible to get the things removed off of “YOUR” credit, you’re wrong. This list just shows you that it doesn’t matter what your credit has on it. IT CAN BE REMOVED!

So sign up today to get your credit on the right track towards financing success. Here’s how.

1. Go to www.CreditandFinancialWellness.com and click on Credit Repair.

2. Read through the brief information on Lexington Law, our approved and reputable Credit Repair Company that has attorney’s fighting for your credit.

3. Click on the “Sign Up” button, enter in the Lexington ID Code #10608 and fill out your information.

That’s it! From there just sit back and watch the items fall off, it’s a blast to see!

Dedicated to your Financing Success!

Kenton Becker

kentonb@empireoptions.com

Managing Partner / Lakemont Mortgage Specialist

License # 510-LO-36929

http://www.empireoptions.com/

Thursday, January 10, 2008

“Why Should I Fix My Credit” – Part 1 of 2 Part Series

In today’s society credit scores are used very often and for many things. Lenders use them to determine your risk associated with offering you credit. It can be used in everything from mortgage loans to auto loans. Some of the areas that are not as commonly noticed but definitely still apply are credit cards, student loans, credit unions, rental applications, employment applications even cell phones and car insurance. If you don’t believe me talk to someone from a cell phone company and let them know you have bad credit.

Sometimes lenders will still offer credit even with a bad report but in each case it will cost you more than you realize to acquire that credit. In the mortgage lending world and for that matter any lending environment, you are given the best terms when you have the best credit. So oppositely you are given the worst terms if you have bad credit. Not only can this affect your ability to get loans but it will also cost you a lot of unintentional money spent because of this.

So now you may be wondering how and why these negative items are reporting on your credit report. Well, even though there are many different forms of negative items, lates, balances, collections, inquiries, length of account history, etc. they all are reported from the same source…your creditor. Usually every 30 – 60 days your creditor or lender will report any new history, whether good or bad, to the reporting agencies. Even if the information is not true…unfortunately it is up to you to fix it. Just as there are many ways that good and bad credit can be reported there are just as many ways that false information can harm your credit report, identity theft is only one example.

It is wise to view your report on a biyearly basis and having a professional walk you through the reporting information can also be very beneficial. There’s a lot of information to look over and it can be very overwhelming to look at, especially if there are lates and erroneous information. I have seen it over and over and over again with clients.

So once you see the different items that are reporting to credit, false or not, there are two areas that you want to focus on fixing. Quite simply they are the items that are not true and the items that are true and are negatively affecting your score.

With the right direction, it can be fairly easy to get false information removed from the report. There are hundreds of articles that can help you with this. The ones that I want to focus on are going to be the items that are true. These can be much more time consuming and difficult. However, I have to add, they may be removed from the report but you still will owe the balance until it’s paid off.

I’m going to leave you hanging…I know, don’t kill the messenger. Next week, I am going to talk about what tools you can uses to get these “true” items taken off your report at a rapid pace. The best part is that in the process this will remove the false information as well. Stay tuned for more info.

Dedicated to your Financial Success,

Kenton Becker

kentonb@empireoptions.com

Managing Partner / Lakemont Mortgage Specialist

License # 510-LO-36929

http://www.empireoptions.com/

Thursday, January 3, 2008

Why Do a Rent to Own – 7 Benefits That Will Drive You to Home Ownership.

There are numerous benefits to going with our Rent to Own program when you are unable to acquire financing. I’m going to list out 7 of the largest benefits that I have found over the last couple years.

Top 7 Benefits:

#1 Building Equity: If you are currently renting, every month you send in a check it goes to the landlord to make him money and pay down his mortgage. After 2 years what will you have to show for it…nothing, except a chunk taken out of your paycheck each month. With our Rent to Own program your payment each month gets credited towards the purchase of your home. Also, because our area is still increasing in value each year at a steady rate you are building equity in the property through appreciation.

#2 Minimum cash out of pocket: Traditionally when you purchase a home you are going to be required to pay standard closing costs and depending on the loan program a down payment. But with Empire Options Rent to Own program you’re only required to pay 1st months rent plus a security deposit equal to your monthly lease payment. That’s it! This can save you substantially when you don’t have much money to spend.

#3 Bad Credit, No Problem: Sometimes people go through rough times with their credit and with our Rent to Own program that’s OK. Our program is a make sense qualification process. We don’t solely look at one thing to make our decision but a combination of your ability to make the payment each month.

#4 Time: Empire Options Rent to Own program gives you plenty of time to get your financial picture ready to go. With our program you can purchase the home anytime between month 13 and month 24. Traditionally most of our clients wait the full term to make sure that everything is in line but for some it makes more sense to buy early.

#5 Improvements and Alterations: One of the highlights of our Rent to Own program is that you have the ability to make improvements to your home. Do you want to replace the carpet, have at it. Paint the house, go for it. Install new counter tops in the kitchen and put in new cabinets, that's great. You are only limited by your imagination because this is your new home.

#6 Greater Financing Options: One major benefit with Rent to Own programs that is heavily overlooked is how you can utilize all the equity that you have gained. To keep it simple, when you buy the home at the end of the lease term you are not purchasing the home at 100% financing but rather refinancing the home at whatever loan-to-value you are at with the new equity. In most cases our clients are able to do a 90% financing loan with a lender, which will give you much better rates and terms.

#7 Pride of Ownership: Biggest of all is that you are getting into your own home. This is no longer a rental or an apartment but your own home that you have picked out. Empire Options Rent to Own program allows you to pick out the home of your choice based on the budget that you have set for yourself.

So that's the top 7 that I have found over the years. There are many more benefits that our clients have found as they have moved forward with the program but for simplicity sake I kept it small.

If you have any questions about our program or if you would like more information about how this program can work for you and your family, let me know. I would be more than happy to help.

Dedicated to your success,

Thursday, December 20, 2007

The Basics of Renters Insurance

Renters face the same risk as homeowners in cases of disasters striking their dwelling. Your landlord or condo association may have insurance, but this only protects the building, not your things in it. Renters insurance can protect your belongings in case of disaster.

What standard policies cover:

There are several types of residential insurance policies. The HO-4 policy is designed for renters, while the HO-6 policy is for condo owners. Both HO-4 and HO-6 cover losses to your personal property from 16 types of perils:

· Fire or lightning

· Windstorm or hail

· Explosion

· Riot or civil commotion

· Damage caused by aircraft

· Damage caused by vehicles

· Smoke

· Vandalism or malicious mischief

· Theft

· Volcanic eruption

· Falling objects

· Weight of ice, snow, or sleet

· Accidental discharge or overflow of water or steam from within a plumbing, heating, air conditioning, or automatic fire-protective sprinkler system, or from a household appliance.

· Sudden and accidental tearing apart, cracking, burning, or bulging of a steam or hot water heating system, an air conditioning or automatic fire-protective system.

· Freezing of a plumbing, heating, air conditioning or automatic, fire-protective sprinkler system, or of a household appliance.

· Sudden and accidental damage from artificially generated electrical current (does not include loss to a tube, transistor or similar electronic component)

Floods and earthquakes aren't on the list. If you live in an area prone to either, you'll need to buy a separate policy or a rider.

Actual cash value vs. replacement cost.

Make sure you let your agent know about any particularly valuable items you have.

One thing to look at is whether the insurance company will offer "actual cash value" (ACV) or "replacement cost coverage" for your belongings. As the name implies, ACV coverage will pay only for what your property was worth at the time it was damaged or stolen. So, if you bought a television five years ago for $500, it would be worth significantly less today. While you'd still need to spend about $500 for a new TV, your insurance company will pay only for what the old one was worth, minus your deductible.

Replacement cost coverage, on the other hand, will pay what it actually costs to replace the items you lost, again minus the deductible.

In some regions, most insurers write ACV coverage. In others, they'll quote you replacement cost coverage by default. Replacement cost coverage will cost you more in premiums, but it will also pay out more if you ever need to file a claim.

Let your agent know about any particularly valuable items you have. Jewelry, antiques, and electronics might be covered up to a certain amount. If you have some items that are unusually expensive, such as a diamond ring, you'll probably want to purchase a separate rider. If you don't talk to your agent about an expensive item when you buy the policy, you probably won't be able to recover the full loss.

Take inventory.

To ensure you are compensated for any belongings you lose from a fire, storm or other catastrophe, you should inventory all of your personal belongings. Your inventory should list each item, its value, and serial number. Photograph or videotape each room, including closets, open drawers, storage buildings, and your garage. Keep receipts for major items in a fireproof place.

Footing the bill when your home is unlivable.

If your apartment or condominium becomes uninhabitable due to a fire, burst pipes, or any other reason covered by your policy, your insurance will cover your "additional living expenses." Generally, that means paying for you to live somewhere else.

Liability protection is also standard with most renters’ policies.

This coverage has a limit of about 30 to 50 percent of the total value of the policy. So, if you're insured for $100,000, your "additional living expenses" limit will be $30,000 to $50,000, depending on your policy terms. Your insurance company will continue to pay while your home is being repaired or rebuilt, or until you permanently relocate. Sometimes 12 months is the longest an insurance company will continue paying. With some policies, you're limited to what the insurance company considers a "reasonable length of time."

Additional benefits.

Liability protection is also standard with most renters and condo policies. This means if someone in your unit slips and falls, you're covered for any costs, up to your liability limit. If this person sues you, you're covered for what they win in a court judgment as well as your legal expenses, up to your policy's limit.

Keeping your premium low.

Just like any other type of homeowners insurance policy, your premium depends on a number of factors: where you live, your deductible, your insurance company, and whether you need any additional coverage.

There are ways to reduce your renters or condo owners’ insurance bill.

Increasing your deductible (the amount you pay before your coverage kicks in) is one strategy. Make sure you can afford whatever deductible you choose.

If you're thinking about getting a dog, you might want to think twice. Some insurance companies are reluctant to write policies for owners of certain breeds.

Most insurers offer a discount for "protective devices," including smoke and fire detectors, burglar alarms, and fire extinguishers.

Some insurers might offer discounts to policyholders who are over age 55 and retired. Others might offer a discount if you buy both an auto and renters policy (called a multi-line discount).

Copywrite - Insure.com

Sept. 24, 2007

The best advice is to talk with your insurance agent. But how do you know if your agent is going to be the best fit for helping you out. Well, go with the experience. The person that I refer all of my clients to is Kevin Hauglie with Farmers Insurance Agency.

Kevin has over 25 years experience in the insurance industry and he is extremely knowledgeable and shares the same level of professionalism as myself and Empire Options does.

Most of the time he has helped our clients reduce there auto loans enough that the savings will pay for the renters policy! And by the way, if you’re thinking that the renters’ policies are pretty expensive…there not. In most cases they are anywhere from $15 - $25 per month.

When my wife and I bought our first home our truck was broken into and my laptop and a few other expensive items were stolen. The total cost of the items came to around $5000! I figured this would be covered in my auto insurance policy…right? WRONG! It’s covered under your homeowner’s insurance policy because it is personal property. Now let’s say that we didn't own the home and this incident happened 2 months prior to us moving in…then what? Well, we would have been out of luck. Renters insurance would cover instances just like this one.

So moral of the story is, GET RENTERS INSURANCE! You can’t afford not to have it.

Do you have any testimonials or experiences of this happening or maybe you have renters insurance and it has been put to good use. I would like to hear about it. Write in my blog to let everyone know of your thoughts.

kentonb@empireoptions.com

Managing Partner / Lakemont Mortgage Specialist

License # 510-LO-36929

http://www.empireoptions.com/

Thursday, December 13, 2007

Tips for buying an existing home

1. Look at the house closely, but be open to the possibilities for improvement.

Imagine your furniture sprucing up the interior. With the same eye toward change, think of the houses you are viewing with a fresh coat of paint or updated countertops. The better a home is updated, the better the resale possibilities.

2. If you are interested in a certain vintage, ask your agent where the best selection of such homes is available and consider the neighborhood.

Is it close to work centers, hospitals, shopping centers? City infrastructure will help the home retain its value.

3. An experienced real-estate agent will have a number of contractors, artisans and interior designers who can answer such questions as "How much will it cost to install new cabinets, counters and appliances in the kitchen? Can this bathroom be enlarged? Can we add on a room?"

They want the work and will be happy to come out and view a home you're serious about buying, to help you in your decision.

But remember, it's still your choice who you work with.

— "Guide to Home Buying" by the National Association of Realtors

Copyright © 2007 The Seattle Times Company

Recently the mortgage guidelines have become tighter and tighter to get into financing and more and more of my clients are having trouble experiencing the joys of home ownership. Empire Options was created for that very reason. We provide rent to own opportunities so that you can still get into the home that you desire.

It is estimated that in 2008 renters will see major increases in rent amounts than in previous years. Just think about the supply and demand, since there are more borrowers renting rather than buying it means that landlords can increase their prices and get away with it.

Right now is a great time to buy. There are a lot of beautiful homes on the market at amazing prices. Plus, you will never have to worry about rent increases anymore!

Last week I received a number of great ideas for why it is better to buy than continue renting. Thank you for the great response.

Next week, I am going to be putting together a blog with a friend of mine Kevin Hauglie. He is a local Farmers Insurance Agent and has over 22 years of experience in the industry. We are going to put together some information about renters’ policies and what you need to know to make sure you are FULLY covered. So make sure you watch for that.

As always, thanks for taking the time to read my blog and if you have any comments or questions, feel free to post them. I am more than happy to assist you.

Dedicated to your success,

Kenton Becker

kentonb@empireoptions.com

Managing Partner / Lakemont Mortgage Specialist

http://www.empireoptions.com/

Wednesday, November 28, 2007

Rebound talk is big at Realtors annual gig

Elizabeth Rhodes: erhodes@seattletimes.com